Impacted Employees

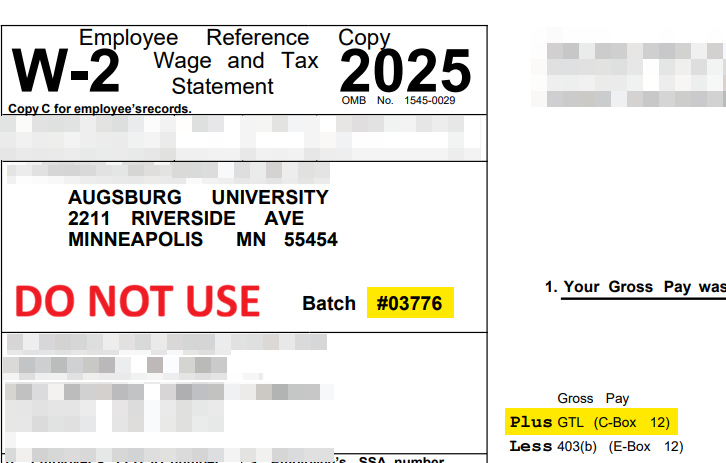

W-2s in Batch #03776 that include “Plus GTL” in the gross pay calculations contain errors. This impacts regular faculty and staff employed at over 0.75 FTE during 2025.

Discard W-2 from Batch #03776

W-2s with “Plus GTL” in Batch# 04214 are ready to File

Your W-2 with Plus GTL in Batch #04214 is ready to file. Paper statements will be mailed, unless you have opted out.

Employees Not Impacted

Errors were only identified on W-2s that include Group Term Life (GTL) insurance.

Student employees, adjuncts, and employees at less than 0.75 FTE are not impacted.

These individuals may use their current W-2 from Batch #03776 to file taxes and will not receive a corrected statement.

If you have already filed your taxes

- Notify your preparer: If you use a CPA or accountant, inform them that a corrected W-2 is available. If your preparer requires a W-2c, please contact payroll@augsburg.edu for assistance.

- Wait for your initial return to process: The IRS recommends waiting until your original return is fully processed before filing an amendment.

- How to Amend:

- CPAs: Provide them with the W-2 with Batch #04214 once received.

- Tax Software (TurboTax, H&R Block, etc.): Use the built-in “Amend a Return” feature once the software updates.

- Save your receipts: Keep a record of any additional fees charged to file this amendment. Contact payroll@augsburg.edu for more information.

We are grateful for your patience and understanding throughout this process. Please do not hesitate to reach out to payroll@augsburg.edu with any specific questions.